Content:

How to get a license

How to get a license for free!

More →

Crypto exchange

Crypto exchange

Version: 24.050

Version: 24.050

Updated: 02.05.2024

Updated: 02.05.2024

Added: 01.07.2015

Added: 01.07.2015

License: Paid-Free

One-time purchase: 98$48$

Rent: from 30$from 28$

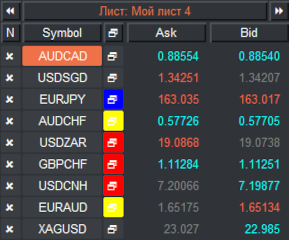

Financial instruments screener for manual search and selection of the most interesting and liquid financial instruments. Designed for MetaTrader 4 and MetaTrader 5 terminals. The best solution for trading stocks.

Version: 22.017

Version: 22.017

Updated: 03.02.2022

Updated: 03.02.2022

Added: 27.03.2018

Added: 27.03.2018

License: Paid-Free

One-time purchase: 169$

Rent: from 30$

VR Smart Grid is a Smart Trading Expert Advisor capable of closing many market positions in batches with small profits. Closing in small batches allows loss-making positions to be reduced quickly and efficiently.

Version: 22.021

Version: 22.021

Updated: 24.02.2022

Updated: 24.02.2022

Added: 22.08.2017

Added: 22.08.2017

License: Paid-Free

One-time purchase: 122$

Rent: from 30$

The trading strategy is similar to the swing strategy, if we made a wrong purchase, then we make a sale. Algorithms for protection against high-risk situations is an interesting feature of this program. VR Black Box uses real Stop Loss and Take Profit levels, and can also use virtual levels, while using real levels, the expert adviser hides virtual levels. I started developing this trading strategy in 2009. A large number of improvements and modifications have been implemented in the VR Black Box expert adviser over this more than ten-year period.

If you learn how to correctly identify support and resistance levels on the charts, you will be able to find trend reversal points with a fairly high probability. One of the most effective methods for determining the market movement both at the current time and in the future is trading using the Pivot strategy. And today we will tell you about the principles of this system, as well as teach you how to apply it in practice.

This term is based on the word Pivot, which means a point of rotation or support. In trading, Pivot points are the price levels of an asset, which can become the place of reversal of the movement of a currency pair or a stock.

If you correctly identify such a point on the chart, you can enter the market with minimal risks and get maximum profit by opening a position at the beginning of a new trend movement.

The main purpose of using these points is to identify resistance and support levels. That is, those places on the chart where the price movement turns down or up. The Pivot strategy allows you to accurately determine such points by simply calculating them using special formulas. By performing the correct calculations, you can create fairly accurate forecasts about future changes in the quotes.

The concept of Pivot levels was introduced in the first half of the 20th century. And since then multiple variations of Pivot points were developed:

The classic and traditional types are very similar to each other. The DeMark system differs from the standard points – it helps to determine the places on the chart where the course may be after a certain time.

The Woodie Pivot is slightly different from the standard version in that in this case the focus is on the closing level of the previous hour (day, week, month).

The Camarilla option allows you to determine not only the current support and resistance levels, but also the points where you need to set a stop loss and take profit.

Formulas for calculating levels

The classical formula is the simplest mathematical model. It looks like this:

This formula is used to calculate the trend reversal point. Using the obtained numbers, you can determine important levels.

Marks:

Similarly, this formula is applied for other timeframes. But instead of days, indicators for the past hours, weeks, etc. will be used.

Of course, today it is not necessary to calculate manually, since modern terminals have special software. You can get Pivot levels for any asset both in the form of a table and in the form of marks on the chart.

If you want, you can also draw them yourself.

DeMark levels are necessary for a qualitative analysis of the current trend and range. They should not be used to accurately determine the points of maximum and minimum.

A new variable (Open) is added to the DeMark formula-it shows the opening point of the trading day.

This formula is only used in combination with other calculation methods.

The main task of these levels is to correctly set the points of limitation of loss and profit.

It is similar to the traditional Pivot mathematical model. In the calculations, the closing level of the previous trading day has a greater weight.

You can apply the Pivot strategy in the same way on different instruments and markets.

Before applying different Pivot formulas, you can test them on the selected market and timeframe. So you can choose the most suitable calculation models. After the appearance of stable results in the "demo" mode, you can start opening deals for real money.

When trading on support and resistance levels, you need to remember a simple principle – the larger the timeframe, the more important the level. This rule is also relevant for the Pivot strategy. But if you are trading within the day, it is better to use hour and half-hour timeframes. Smaller timeframes are not worth it.

At the same time, daily candlesticks should be used to identify points at which the trend can turn in the opposite direction. The levels on the M30 chart will help determine where the price can consolidate within the current trading session.

Breakdowns and rebounds may appear in places of consolidation, and there may be optimal entry points. But experienced traders recommend trading on timeframes not lower than H1.

If you can afford to wait a long time, then it makes sense to even work with a weekly chart (W1) and at the same time watch strong levels on a monthly timeframe. Important places on such time intervals will be significantly stronger in comparison with the daily points.

To get an extremely accurate analysis, it is necessary to take into account the main market factors:

It is also important to test different strategies for applying Pivot points in order to find your favorite one.

Experienced traders claim that with the correct identification of trend reversal points, you can get an annual profit of 60% of the deposit or more. How high the net profit indicator will go depends largely on your personal experience, as well as on your preferred timeframe.

Pivot levels are focused on determining global changes in the direction of movement. Opening a deal on a new trend at the point of its formation, you can get a lot of profit points.

Here is an example of setting Pivot points in the USD/CAD pair. This is an hourly chart.

At point 1, the market opened. At the second point, there was a breakthrough of an important level. From this moment, work began in the channel in order to open a trade on the rebound from the points S1 or R1.

After an unsuccessful attempt to make money on the purchase, a sell order was opened at point 5. It was a rebound from the R1 point. As a result, the transaction brought 55 points of profit. It remained open for 1.5 days.

For longer intervals, the Pivot works even better. At the rebound, you can catch good movements and the larger the timeframe – the higher the profit level.

Here are some more examples.

If you want, you can combine Pivot with basic indicators. For example, volume indicators, moving averages, etc.

As you can see, there is nothing complicated in this strategy. Moreover, all calculations can be automated using special services. Once you have mastered Pivot point trading, you will better understand and predict future chart movements. And thereby increase your own profit.

In order not to make calculations manually, you can use a special indicator for MetaTrader, which will automatically make all the calculations - VR Pivot.

Share your experience of using pivot control levels in trading in financial markets in the comments below.

Even more in the Telegram community

Even more in the Telegram community

Send us a message

Send us a message

Comments