Content:

How to get a license

How to get a license for free!

More →

Crypto exchange

Crypto exchange

Version: 25.030

Version: 25.030

Updated: 02.03.2025

Updated: 02.03.2025

Added: 28.10.2022

Added: 28.10.2022

License: Paid-Free

One-time purchase: 189$79$

Rent: from 30$from 15$

The VR Lollipop trading robot is an automated trading strategy designed to operate on trend movements of various financial instruments. Its main goal is the accumulation of profitable positions.

Version: 24.121

Version: 24.121

Updated: 13.12.2024

Updated: 13.12.2024

Added: 22.08.2017

Added: 22.08.2017

License: Paid-Free

One-time purchase: 122$85$

Rent: from 30$from 21$

VR Black Box is a powerful trading system built on the principle of following price movements. The trading robot has access to the functions of setting both real and virtual Take Profit and Stop Loss levels. The main objective of the algorithm is to maximize profits and minimize risks.

The VR Black Box system uses a combination of real and virtual stop loss and take profit levels, with the real levels hiding the virtual ones. The development of this strategy began in 2009, and over a period of more than ten years it has undergone many improvements and revisions. The principle of operation is reminiscent of the “Swing” strategy, when a purchase error is compensated by entering a sale. A special feature of the system is the presence of protective mechanisms to prevent getting into high-risk situations.

Version: 17.100

Version: 17.100

Updated: 12.08.2015

Updated: 12.08.2015

Added: 04.08.2015

Added: 04.08.2015

License: Free

One-time purchase: 0$

Rent: from 0$

Designed for closing/deleting all orders in the terminal. It helps to fix profit or loss on the entire trading account.

The coronavirus outbreak is now one of the most discussed topics. Some social networks, for example, Vkontakte, have even created a separate section dedicated to the topic of the pandemic, for the convenience of tracking current information.

Despite the fact that the virus appeared quite recently, the world is gripped by panic associated with the rate of spread of coronavirus and other factors. The world market reacted to the outbreak of the epidemic: stocks suffered the strongest fall in the last 2 decades. Schools are closed for quarantine, and stores are frantically buying up stocks of cereals and toilet paper. This has spawned a huge number of memes on the Internet. What coronavirus is and why it is so dangerous for the global economy, we will tell you in this article.

On December 31, 2019, the first case of coronavirus disease was recorded in the Chinese city of Wuhan, Hubei Province: the victim was diagnosed with pneumonia with non-standard symptoms. The source of the epidemic was the Huanan seafood market, and local animals became carriers of the virus. Presumablythese were batsor snakes, which are considered a delicacy in these parts. In just four days, the new virus spread throughout the entire territory of Wuhan, and the number of cases rose to 44 people. Three days later, the Chinese government announced an outbreak of a new coronavirus, which leads to various complications, and the city was quarantined.

The new coronavirus is an unknown and not previously encountered strain of a family that includes 40 RNA-containing viruses, whose structure resembles the solar corona, from which it originated Name. Viruses of this family are the causative agent of acute diseases, such as atypical pneumonia or acute respiratory syndrome, which can cause death in a patient.

The new coronavirus was given the code name COVID-19. The virus went far beyond the source of excitement and spread throughout the world in less than two months. On March 11, 2020, the World Health Organization announced the official start of the pandemic and called for all necessary measures to be taken to contain the virus.

Sooner or later the crisis will end, this was the case in 1998, this was the case in 2008, this was the case in 2014. Every time there are new reasons for the decline of the world economy. Companies are getting cheaper, money is depreciating, products and life are becoming more expensive. This has happened before and this will happen more than once in the future. What to do?Sit back? Any crisis is a new opportunity.... Choose a trading robot and try your hand at trading in the financial markets... You may be able to succeed at the moment crisis.

People who are not concerned about the consequences of the spread of coronavirus often resort to morbidity statistics and erroneously believe that the media is artificially whipping up panic among the population. As their evidence, they cite the fact that on average, more people die from a regular flu epidemic per month than during the entire existence of the coronavirus. Statistically, this is true: according to WHO, from 300 to 650 thousand people die from influenza every year. But it is incorrect to compare these two forms of viral infection for several reasons:

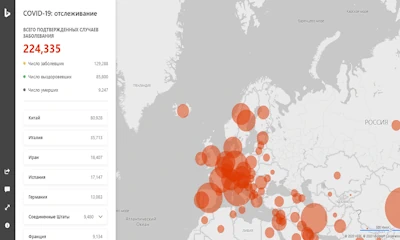

For these reasons, coronavirus is considered dangerous. The pandemic has caused no less damage to the global market. As of March 19, 2020, more than 224 thousand people were infected with coronavirus in the world, of which 9,247 died and 129,288 recovered.

Statistics provided by Bing

Against the background of the coronavirus outbreak and the WHO announcement of the beginning of a pandemic, stock market indices began to fall rapidly. During periods of uncertaintyinvestors begin to sell offtheir assets in the market. Some experts believe that we are on the verge of a new global economic crisis, which may surpass the global crisis of 2008 in scale.

One of the leading American indices, the S&P 500 for the month, fell by almost 30% from $3,387 to $2,398, and the RTS index over the same period fell by almost 45% from 1,544 to 864 rubles. The Russian stock market has not had such a strong drop since 2015, when the index fell from 1,400 to 627 rubles in six months.

At the end of February 2020, the global stock market lost about $6 trillion with a capitalization of $85 trillion. The fall in indices is caused by a decline in production in the Chinese sector of the economy. Manufacturing in China has shrunk by a record 13.5% over the past 30 years. In response to the spread of the virus, not only production began to close, but also the export of goods. The last time this happened was in 1998. Retail sales in Chinese stores fell by more than 20%, and exports of goods from China fell by 17%. Apple brand stores and Starbucks coffee shops are closed in many regions of China. Apple shares fell 25% in a month, and Starbucks shares fell 39%.

The magnitude of the economic decline in different countries, %

According to The New York Times experts expect global economic growth to grow by 2.3% in 2020, and in the event of a pandemic - by 1.8%. Bank of America forecast growth of 2.8%, however, given the situation, the forecast seemstoo optimistic. The current economic situation has exceeded all expectations. Economists do not deny thatthe world market is close to a recession. In an attempt to deal with this, the US Federal Reserve lowered the federal funds rate to 0.25% - 10 times less than the previous year (2.5%). These measures are being taken to contain the crisis situation exacerbated by the coronavirus pandemic.

At the same time, the position of the dollar and the euro strengthened. The dollar exchange rate exceeded 80 rubles, and the euro reached 87 rubles. This has not happened since Black Tuesday 2014, when there was a sharp collapse of the ruble, and the dollar reached 80 rubles, and the euro - 98 rubles. If the situation does not change for the better, then analysts predict a further rollback of the ruble, and we may see a rate of 90 rubles. per dollar, and some experts admit that the fall may continue down to 100 rubles. per dollar.

The fall of the ruble may be due to higher prices for products and an increase in prices for imported goods. Russia is still heavily dependent on exports, in particularproducts from China. The share of Chinese imports to Russia is 82% of the total volume of foreign goods. However, domestic retail chains aretaking measuresto reduce dependence on imported food products. For example, representatives of Magnit network stated that they plan to increase their own production of products by 30%. Magnit has already stopped importing vegetables and fruits from China and replaced them with supplies from other regions of Russia.

Any crisis is a new opportunity for self-realization and success. When we emerge from a crisis, thousands of new opportunities open up. Since during the crisis, many closed or reduced their volume of work. Then, when we emerge from the crisis, a new round of development of the world economy begins, which makes it possible to become a successful entrepreneur or trader...

The rapid development of coronavirushas forced governments of different countries to strengthen quarantine measures to contain the pandemic. This has affected travel and airline companies.

At the meeting of OPEC, a decision was made to reduce oil production, but Russian representatives refused to conclude an agreement and stated that they were not going to reduceproduction volumes. The decline in production and the reduction in supplies triggered a decline in oil prices. In China alone, oil consumption has decreased bymore than 20%since the coronavirus outbreak. In addition to this, airlines began to close flights to a number of countries, and some regions closed their borders. The Russian airline Aeroflot has canceled flightsto Italy, France and Israel. Russia recently closed its border with the Republic of Belarus. Now the Russian government has closed the state border until May 1, with the exception of special cases when foreigners need to stay outside the territory of the Russian Federation. The United States and the European Union have also introduced entry restrictions.

These measures will hit the transport and tourism business hard. Aeroflot shares fell by 53% over the month and fell below 60 rubles for the first time in four years. Shares of the American airline American Airlines fell even more - by 64%.

Cheaper oil is forcing companies to look for ways to cover losses. Despitethe fall in oil prices, gasoline not only did not decrease in price, but also continued to rise in price. For example, AI-95 gasoline increased by 8 kopecks per liter, taking into account the fact that oil prices fell by more than 2 times. The Bank of Russia decided to sell foreign currency from the reserves of the National Welfare Fund (NWF). The amount of currency sold will be calculated depending on fluctuations in the price of Urals oil. The goal is to keep oil from falling below $25 per barrel.

The weakening of the ruble and falling oil prices will lead to an increase in the tax burden. In 2020, the Russian authorities plan to increase income tax to 16%, but abolish the tax onindividual income. There are no plans to increase VAT yet, but everything may change depending on the situation with the development of coronavirus.

It is too early to talk about the global financial crisis. Economist Nouriel Roubini believes thatinvestors' expectations are wrong. Initially, investors assumed that the spread of coronavirus would be limited to China. Then, in their opinion, the pandemic should have been stopped in the secondquarter of 2020. Based on current statistics, it becomes obvious that this will not happen and the pandemic will continue.

The coronavirus has managed to mutate into a new form, but it is weaker compared to its predecessor. Scientists believe that the pandemic could last up to two years, andthe development of a prototype vaccinewill be completed only within three months. Schools and many other institutions are closed for quarantine.

In the current situation, investors have the opportunity to improve their fortunes by trading in financial markets: opening short positions on the stock market or increasing their exposure to foreign currencies USD and EUR.

Many experts and analysts look at the market positive and assume that the crisis situation in the global market will not last long, after which shares will quickly recover and be able to reachnew highs . However, Nouriel Roubini refers to statistics: to assess the pace of recovery, one shouldpay attentionnot to how much market indicators have fallen, but to the rate of economic growth in previous years. Even with optimistic forecastsGDP cannot significantly exceed the growth of existing indicators.

Therefore, a rapid market recovery seems too optimistic a forecast. In addition, the situation with the spread of coronavirus is not completely clear. Scientists previously reportedthat we had passed the peak of the pandemic, but this turned out not to be the case. It is unlikely that the pandemic will reach catastrophic proportions, but we should not expect it to be stopped within the next 3 months.

Our resource is dedicated to trading on financial markets, now is the most interesting time for traders. Most currencies have fallen in price, very much, which means that when emerging from the crisis, purchasing currencies, a trader can benefit from operations on the Forex market. Take a closer look at our tools for automatic trading in financial markets; perhaps becoming a trader is your calling.

Even more in the Telegram community

Even more in the Telegram community

Send us a message

Send us a message

Comments