Version: 25.070

Version: 25.070

Updated: 10.07.2025

Updated: 10.07.2025

Added: 17.11.2014

Added: 17.11.2014

License: Shareware

VR Trade Panel is a professional solution for trading, which allows you to effectively manage positions using trend lines. Unique functionality allows you to install Stop Loss and Take Profit both at dynamic levels (inclined lines) and fixed values.

Version: 25.030

Version: 25.030

Updated: 02.03.2025

Updated: 02.03.2025

Added: 28.10.2022

Added: 28.10.2022

License: Paid-Free

The VR Lollipop trading robot is an automated trading strategy designed to operate on trend movements of various financial instruments. Its main goal is the accumulation of profitable positions.

Version: 24.050

Version: 24.050

Updated: 02.05.2024

Updated: 02.05.2024

Added: 01.07.2015

Added: 01.07.2015

License: Paid-Free

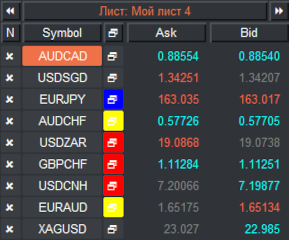

Financial instruments screener for manual search and selection of the most interesting and liquid financial instruments. Designed for MetaTrader 4 and MetaTrader 5 terminals. The best solution for trading stocks.

Version: 25.033

Version: 25.033

Updated: 06.04.2025

Updated: 06.04.2025

Added: 27.03.2018

Added: 27.03.2018

License: Paid-Free

VR Smart Grid is a smart trading adviser capable of closing a large number of market positions with a small profit. Closing in small parts allows you to quickly and effectively reduce unprofitable positions.

Version: 24.121

Version: 24.121

Updated: 13.12.2024

Updated: 13.12.2024

Added: 22.08.2017

Added: 22.08.2017

License: Paid-Free

VR Black Box is a powerful trading system built on the principle of following price movements. The trading robot has access to the functions of setting both real and virtual Take Profit and Stop Loss levels. The main objective of the algorithm is to maximize profits and minimize risks.

The VR Black Box system uses a combination of real and virtual stop loss and take profit levels, with the real levels hiding the virtual ones. The development of this strategy began in 2009, and over a period of more than ten years it has undergone many improvements and revisions. The principle of operation is reminiscent of the “Swing” strategy, when a purchase error is compensated by entering a sale. A special feature of the system is the presence of protective mechanisms to prevent getting into high-risk situations.

Version: 22.040

Version: 22.040

Updated: 11.04.2022

Updated: 11.04.2022

Added: 30.08.2017

Added: 30.08.2017

License: Paid-Free

The program trades according to a unique logic, the task of which is not just to fix the profit, but also to use the accumulated profit as a safety cushion, which significantly reduces the drawdown on the balance.

Version: 17.100

Version: 17.100

Updated: 12.08.2015

Updated: 12.08.2015

Added: 04.08.2015

Added: 04.08.2015

License: Free

Designed for closing/deleting all orders in the terminal. It helps to fix profit or loss on the entire trading account.

Version: 16.120

Version: 16.120

Updated: 13.12.2016

Updated: 13.12.2016

Added: 10.09.2014

Added: 10.09.2014

License: Free

The expert Advisor's interface is intuitive and easy. The EA hides the take Profit, Stop Loss, Breakeven, and Trailing Stop trading levels.

Trading robots are used to automate the process of trading in financial markets. They allow traders to perform repetitive tasks without the need for constant human supervision, which greatly improves the efficiency of a trader.

Trading robots can be used to trade various financial instruments such as stocks, currencies, commodities, etc. They work around the clock without human intervention and use various data analysis methods to make decisions to buy or sell assets.

Trading robots can be useful for both professional traders and beginners in the field of investment. They help automate the trading process and reduce the risk of losses associated with human error.

In addition, trading robots can generate significant profits due to the opportunity to profit from successful trades. They can also be used as a risk management and hedging tool.

However, it should be remembered that trading robots are not a guarantee of successful trading. They are just a tool that helps traders make decisions based on data analysis. It is also important to consider your personal strategies and experience when using trading robots.

The earnings of a trading robot depend on several factors, including the algorithm used, the level of risk, the liquidity of the instrument the robot trades on, and market conditions.

For example, a robot used to trade stocks in high-risk markets can potentially make a lot of money, but this depends on its performance and efficiency. A robot used to trade less risky markets can potentially make less money.

It should also be noted that the earnings of a trading robot are not constant and may vary depending on changing market conditions and other factors. In general, the earnings of a trading robot can be quite high, but it can also be quite low.

Even more in the Telegram community

Even more in the Telegram community

Send us a message

Send us a message

Comments