Content:

How to get a license

How to get a license for free!

More →

Crypto exchange

Crypto exchange

Version: 17.100

Version: 17.100

Updated: 12.08.2015

Updated: 12.08.2015

Added: 04.08.2015

Added: 04.08.2015

License: Free

One-time purchase: 0$

Rent: from 0$

Designed for closing/deleting all orders in the terminal. It helps to fix profit or loss on the entire trading account.

Version: 24.050

Version: 24.050

Updated: 02.05.2024

Updated: 02.05.2024

Added: 01.07.2015

Added: 01.07.2015

License: Paid-Free

One-time purchase: 98$48$

Rent: from 30$from 28$

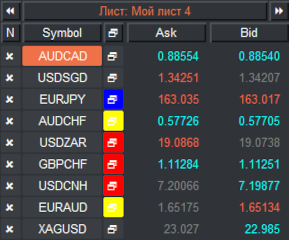

Financial instruments screener for manual search and selection of the most interesting and liquid financial instruments. Designed for MetaTrader 4 and MetaTrader 5 terminals. The best solution for trading stocks.

Version: 25.030

Version: 25.030

Updated: 02.03.2025

Updated: 02.03.2025

Added: 28.10.2022

Added: 28.10.2022

License: Paid-Free

One-time purchase: 189$79$

Rent: from 30$from 15$

The VR Lollipop trading robot is an automated trading strategy designed to operate on trend movements of various financial instruments. Its main goal is the accumulation of profitable positions.

In this article we will look at drawing up the correct technical specifications for a programmer working in financial markets. Modern technologies allow you to fully automate any trading strategy and free the trader from tedious:

If you want to automate your trading strategy, you will need a person with programming skills and a good understanding of the specifics of trading in financial markets.

Finding a programmer is half the trouble; the main difficulty is how to explain to the programmer what you want. It would seem that there is nothing complicated, the indicator shows BUY, the advisor is buying, the indicator shows SELL, the advisor is selling, but in fact, for these simple actions, the program must perform a lot of preliminary steps.

Most of these indicators must be taken into account by the customer, because the programmer does not know whether checking for permitted lots is needed or not. The customer must understand that a lot of unnecessary checks greatly slows down the operation of the program; therefore, the customer must describe and think through the trading strategy for automation in as much detail as possible.

A competent technical specification significantly reduces the time of writing a program; in the case of a paid order, the cost can be minimal, and what is important to note is that the customer will receive the desired result without unnecessary problems.

Technical specification or (TOR) is a complete description of a trading strategy, taking into account the exact state of time, price, indicators or other additional mathematical objects, as well as with a precise indication of the actions and behavior of the program in real, test conditions.

The technical specification must contain three blocks:

Position opening block - conditions under which the program opens or places orders in the market. Indicator signals taking into account time, bar number, bar state, bar size and other conditions...

Block of holding a position in the market - describes all the conditions for modifying orders, this can be a trailing stop, a stop loss, or a take profit. It describes everything that the program should do with a position that is in the market.

Position closing block - conditions under which a position must be fully or partially closed.

The programmer, like the computer, understands only clear conditions of yes, no, and, or. If your technical specification contains words and phrases like: Approximately, around, somewhere here, in the area, here, think for yourself, it should bring profit, the grail, somehow. Then your technical specification is not suitable, you will waste your time, the programmer and your funds.

Trading strategy based on two moving averages.

Opening orders:

The fast moving average crosses the slow one and when a new bar appears, an order is opened, regardless of whether there are already orders in the market or not. The open order is set to Take Profit according to the settings and Stop Loss. The bar period depends on the chart on which the advisor is installed.

Order modification:

Stop Loss is placed below the local minimum for buys and above the local maximum for villages for the last 24 bars. For all orders, a trailing stop is applied according to the EA settings.

Closing orders:

By take profit, by stop loss, by reverse signal.

Lot calculation block:

If the last order was closed with a loss, then the lot for the new order will be doubled.

If the last order was closed with a profit, then for the new order the lot will be reset to the initial settings

Advisor settings block:

Even more in the Telegram community

Even more in the Telegram community

Send us a message

Send us a message

Comments