Content:

How to get a license

How to get a license for free!

More →

Crypto exchange

Crypto exchange

Version: 24.050

Version: 24.050

Updated: 02.05.2024

Updated: 02.05.2024

Added: 01.07.2015

Added: 01.07.2015

License: Paid-Free

One-time purchase: 98$48$

Rent: from 30$from 28$

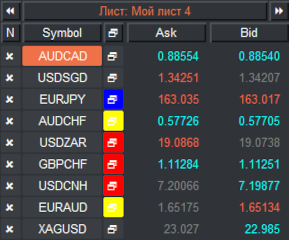

Financial instruments screener for manual search and selection of the most interesting and liquid financial instruments. Designed for MetaTrader 4 and MetaTrader 5 terminals. The best solution for trading stocks.

Version: 25.066

Version: 25.066

Updated: 21.06.2025

Updated: 21.06.2025

Added: 17.11.2014

Added: 17.11.2014

License: Shareware

One-time purchase: 0$

Rent: from 0$

VR Trade Panel is a professional solution for trading, which allows you to effectively manage positions using trend lines. Unique functionality allows you to install Stop Loss and Take Profit both at dynamic levels (inclined lines) and fixed values.

Version: 25.030

Version: 25.030

Updated: 02.03.2025

Updated: 02.03.2025

Added: 28.10.2022

Added: 28.10.2022

License: Paid-Free

One-time purchase: 189$79$

Rent: from 30$from 15$

The VR Lollipop trading robot is an automated trading strategy designed to operate on trend movements of various financial instruments. Its main goal is the accumulation of profitable positions.

A trading strategy, or system, is a set of clearly defined rules and a sequence of actions that a trader applies in various market conditions in order to make a profit in the Forex market and other financial platforms.

Simply put, a trading strategy is a kind of plan or instruction that determines the trader’s actions depending on the current situation on a specific financial instrument.

It is worth noting that the same trading strategy may not work equally effectively in different markets. A strategy designed for Forex trading may not be as successful when used in the stock or cryptocurrency markets.

Having once developed a trading strategy, a trader can subsequently consistently and for a long time make profit from trading financial assets.

For systematic profit generation in financial markets. A trading strategy reduces psychological stress, eliminates panic, gives confidence in trading, has a clear plan of action in all situations, including when a trader receives excess profit, and ensures profit at the end of the trading period. p>

Most financial markets are an area of price chaos, where the value of an instrument can increase, decrease, or remain the same. In order not to get lost in this chaos and achieve the desired profit, you must strictly adhere to the developed rules of the trading strategy.

According to statistics, traders who make consistent money in the financial markets use a trading system. At the same time, those who do not use the trading system stably and systematically lose all their money.

Creating your owntrading strategy is a large and painstaking process, which includes a large number of tests of various indicators, trading systems, technical analysis figures, fundamentals strong> data.

Here are a few steps to help you create your trading strategy:

It is important to rememberthat creating a successful trading strategy takes time and effort. Please be patient and expect that results may vary.

The main factors of a high-quality and profitable trading strategy include the following aspects:

The more complex and understandable the trading strategy, the greater the chances of success. Let us remember that everything simple is ingenious, and everything ingenious is simple.

It would be good to take as a basis the trading strategies of other traders or study classical trading strategies that have been tested by time and by other traders. However, when taking someone else's strategy as a basis, it is important to understand that each trader is unique and has his own approach to trading. Therefore, it is recommended to adjust your trading strategy to suit yourself and your trading style.

To develop a trading strategy, the optimal solution would be to use demo trading accounts or accounts where there is no risk of losing your own funds.

Even now, in modern times, technical analysis is considered one of the most effective methods. Studying techniques for working with support and resistance levels, technical analysis figures and Japanese candlestick combinations will help you more accurately determine when to enter the market, hold positions longer and more efficiently, and exit the market with maximum profit.

It is recommended to use technical analysis together with fundamental analysis. You shouldn't rely entirely on the news, but you shouldn't ignore it either. Practice shows that experienced traders advise avoiding trading during the release of important news. The news background has a significant impact on currency movements a few days before the news is released and a few more days after.

Pay attention to indicators that greatly facilitateprice analysis and can become excellent assistants. Don't overload your work schedule with many indicators. For comfortable work, it is enough to use no more than three (indicators displaying time, balance, trading account statistics, trading sessions are not taken into account).

The trading strategy must be clearly defined for the different phases of the financial instrument. You should not try to create a strategy that works equally well both in a trend and in a flat. It is better to focus on developing a stategy for the trend, since in a flat without increasing trading volumes it is difficult to earn good money, and an increase in volumes entails an increase in the risk of losing money that exceeds acceptable limits.

The trading strategy must demonstrate a positive mathematical expectation of a coefficient of more than 2 over a trading period of at least 60 days and 100 trading operations, including all three phases of the market: a rising trend, a flat or sideways trend, a downward trend.

Trading strategies can be classified into several types, each of which has its own characteristics:

One of the common mistakes among traders is deviation from the rules of the developed trading strategy. After several failures or receiving excess profits, traders often deviate from pre-established rules, which can lead to loss of money.

Changing your trading strategy on a regular basis is also a mistake. After several losing trades, traders begin to think that their strategy is no longer working, and they try to change the indicators and rules of the strategy several times a day or even an hour. However, only testing a strategy with certain parameters can show whether it is profitable or not.

Getting profits and excess profits is normal, but you should not change the rules of your trading strategy after that in order to get even greater profits. Also, do not neglect the rules of the strategy when opening new positions, even if previous transactions were successful.

Loss is also a normal element of trading. A well-thought-out strategy can include 3 profitable trades out of 10 and 7 losing ones, but still bring a stable income. Therefore, it is important to remember thatthe more losses in a row were received following the rules of the strategy, themore likelythat the next trades will be profitable and will not only compensate for the losses, but will also bring < strong>additional profit.

Trading is not just a game on the stock exchange. You can both win and lose. However, most successful traders achieve success when they stop playing and start taking trading seriously and professionally.

The question of the best trading strategy does not have a clear answer. Just like choosing the best food or car, it all comes down to individual preferences and needs. The best strategy is one that you have developed, honed, and fully understand. This is a strategy that you caneasily calculate in your mindand that brings you the greatest profit with minimal investment of time, money and nerves.

To assess the profitability of a trading strategy, you can use several key mathematical formulas:

Profit / Loss = Result; The greater the result, the more profitable the strategy is; for good strategies, the result should have a value greater than or equal to 2. The mathematical expectation is best calculated for trading strategies for which more than 100 trading operations were carried out.

Profit 155,365 rubles / Loss 122,659 rubles = Result 1.2666 Result less than 2x, even though the final result in money is positive, such a trading strategy will be highly risky.

Profit 142,326 rubles / Loss 40,233 rubles = Result 3.5375 The result is more than 2x, with such indicators the trading strategy will be considered very profitable and low risk, since the profit is three times greater than the losses.

(Profit - Loss) / Number of days traded = Result; The result represents the net profit per day, and the higher it is, the more profitable the trading strategy. The difference from the mathematical expectation formula is that the real profit formula does not give an idea of the coefficient, so it will be very difficult to assess risks. In this formula, a positive result should be expected and targeted for the trader.

(Profit - Loss) / Starting deposit / 100 = Result. This formula shows the percentage of profit on the initial starting deposit. If the interest is less than the interest offered by a regular bank on the same deposit, then it is more profitable to place the money on a bank deposit.

Consider a simple strategy based on the Alligator indicator:

Alligator is an indicator created by Bill Williams. It consists of three lines, which represent moving averages with a certain shift. These lines, called jaws, teeths, and lipss, serve to alert traders to the presence of a trend or consolidation in the market.

Alligator default settings:

The strategy uses three states of the alligator indicator:

Entering the market occurs at the moment when the alligator awakens. For a more accurate entry, many traders prefer the moment the new period begins. To close a position, a reverse signal or Take Profit or Stop Loss levels are used.

Automation of the trade strategy can be achieved by using specialized software products such as Metatrader 4 or Metatrader 5. These platforms provide the opportunity to create and test automatic trading systems using the MQL4 or MQL5 programming language, respectively.

You can independently study the MQL programming language using the author’s course mql master and automate your trading strategy.

Automation significantly saves the time - the trader is exempted from many hours of control of graphs and financial instruments. The trader does not miss trading signals at night or at the time of the terminal.

Automation removes emotions from trading - the trading robot works strictly by the programmed algorithm and clearly, without a doubt, performs all the actions according to the trade strategy.

Automation significantly increases the effectiveness of the trader in financial markets. The ability to automate trading strategies makes traders much more successful than those who continue to trade manually.

Trade in financial markets without a trading strategy is, to put it mildly, is not the most pleasant activity . In most cases, this approach leads to cash loss . Stable profit from financial markets is possible only when using well -thought -out and balanced trading strategy .

Even more in the Telegram community

Even more in the Telegram community

Send us a message

Send us a message

Comments